Bring ACFCU with you wherever you go! With Online and Mobile Banking, access to your accounts is always at your fingertips.

Push To Pay

Pay quickly and securely with your mobile wallet.

We’ve made it even easier and more secure to shop in-store, dine out, or visit your favorite entertainment venue. Say goodbye to scrambling for your wallet at the checkout line. Just add your ACFCU Visa® credit or debit card to your mobile wallet and you can make quick payments without cash or the cards themselves.

How To Add Your Card To Your Mobile Wallet:

- Log into the Mobile App.

- Click on Card Controls.

- Select your card.

- Swipe down until you see Add to G Pay or Apple Pay.

Why Should I Use My Mobile Wallet?

Using a mobile wallet streamlines your payment processes, adds an extra layer of security, and provides much more convenience. You don’t need to wait for your plastic card to come in the mail to add it to your mobile wallet. Don’t use a mobile wallet? No problem! You can easily view your card details whenever you want—your card number, expiration date, and CVV code are all in Online and Mobile Banking. If you do use a mobile wallet, you can easily load your card into your wallet without the hassle of manual entry. When you use your credit or debit card to make a purchase, the mobile wallet applies a random identification number to your purchase instead of providing your credit card information. This makes it harder for scammers to access your personal and financial information.

Enroll in Electronic Statements

Ready to reduce your carbon footprint?

Have the power to access your current or previous statements whenever and wherever you want. We make it simple with electronic statements.

How To Enroll In Electronic Statements:

- Log into your online banking account from your computer and go to Notifications

- Click on eDocs

- Click on Overview

- Click on the Gear Wheel

- Select Subscribe

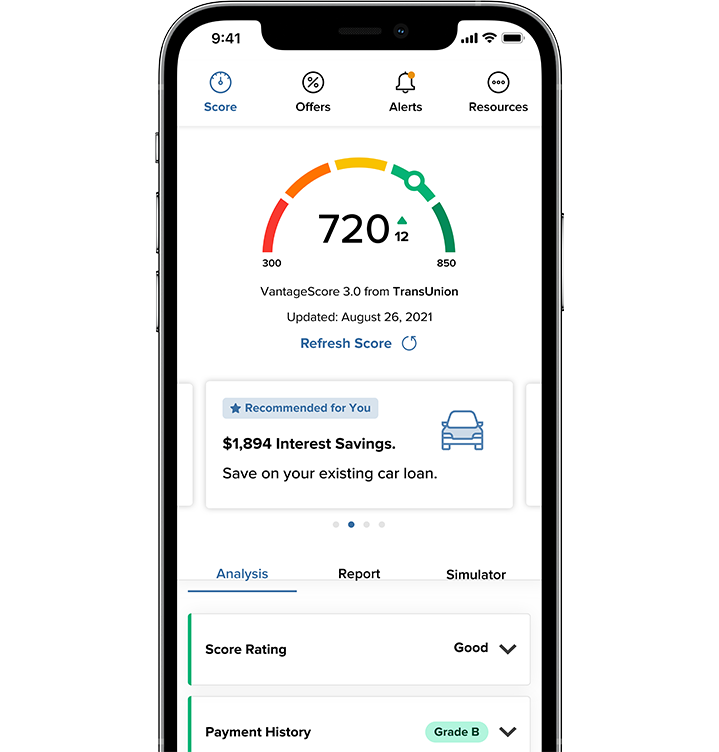

Credit Score

Powered by SavvyMoney.

Check your credit score for free at any time with Credit Score by Savvy Money. Easily sign up and receive notifications on score changes, special offers, and financial tips.

How To Get Started:

- Log into the ACFCU Mobile App or Online Banking

- Select the Financial Wellness icon

- Select Credit Score

- Sign up and enjoy access to your credit score, credit reports, financial education, and more

- Daily access to your credit score

- Real time credit monitoring alerts

- Personalized credit report

- Credit score simulator

Bill Pay

Manage your bills and save time and money.

Online and Mobile Banking Bill Pay take the worry out of paying your monthly bills with customized automatic payments made directly from your ACFCU checking account.2

- Pay bills conveniently, easily and securely

- 100% payment guarantee

- Schedule one-time, recurring, same- or next-day payments

Digital Banking

Greater financial control is at your fingertips.

With Arlington Community FCU’s mobile app and online banking, you can view transactions, balances and checks, manage credit and debit cards, update your contact information, and much more. It’s easy to set up and quickly get increased convenience and account security.

- Manage all your banking quickly, safely and securely

- Pay bills, loans, and your ACFCU credit card

- Transfer money between internal, external, and other Arlington members’ accounts

- Send secure messages, access notices and e-statements and create budgets and savings goals*

- Set card alerts and card controls: block and unblock cards as needed, block international transactions, set dollar amount limits on Signature, PIN, ATM transactions, and more through the Card Management widget

- Manage your ACFCU debit card, see how close you are to qualifying for rewards on your Cash Back Checking account1

- Access your ACFCU credit card, view rewards, take a cash advance, make a payment, block your card and transfer other credit card balances to your ACFCU credit card

- Stop payments for a lower fee, request domestic wires, and order checks

- View account information for non-Arlington accounts

- Monitor your credit report and get financial tips with SavvyMoney

- Link internal and external accounts

- Use Password managers

- Use Authentication Apps

Plus on the Mobile App:

- Deposit checks using your smartphone’s camera with Mobile Deposit3

- Use Mobile Wallet to pay with your debit or credit card at participating locations

- Download via Apple App Store ® or Google PlayTM

Mobile Deposit

Deposit checks using your smartphone’s camera.

Skip the trip to your local ACFCU branch and deposit checks using our Mobile Banking app3 on your smartphone or tablet—just open up the Mobile Deposit widget and follow the instructions

- Deposit checks using our Mobile Deposit widget and the camera on your smartphone or tablet3

- Eligible endorsed checks from US financial institutions include personal, cashier/official, teller, and US Treasury and are processed in the same amount of time as in-branch and ATM check deposits3

- Foreign checks, money orders, and savings bonds are not eligible for Mobile Deposit

Mobile Wallet

Make contactless purchases.

Leave your wallet at home and enjoy secure, contactless buying experiences when you use ACFCU’s Mobile Wallet to pay with Apple Pay®, Google PayTM, or Samsung® Pay. Learn how to access and use your Mobile Wallet now.3

- Use your phone to pay as you go about your day with Mobile Wallet for your ACFCU Visa® debit and credit cards*

- Contactless, safe and secure buying, whether you use it online, in apps or at a store by tapping your device at a payment terminal

- Earn the same rewards at stores and restaurants that you would with your physical card4

Money Transfers

An easy way to move your money.

Transfer up to $10,000 a day between Arlington and/or external accounts with just a routing number, account type, and account number with these easy steps.

Electronic Documents

Receive documents digitally.

Access statements, notices and tax documentation all in one place. Never search for an ACFCU document again.

- Access your statements online—as soon as they’re available—and previous statements as far as 24 months back

- e-statements help you qualify for Free Rewards Checking rewards

- Receive certificate maturity, late loan payment, and year-end tax documents via electronic notices

Overdraft Protection

Create peace of mind with Courtesy Pay, which acts like insurance against overdraft fees for your checking account.

Whether you overestimated your account balance or swiped your debit card before you reviewed the total, we offer coverage to protect your account.

Courtesy Pay covers the following types of transactions:4

- Checks, ACH and other transactions made using a checking account

- Automatic bill payments

- Recurring transactions set up using your debit card

- ATM transactions

- Everyday debit card transactions

- Point of Sale (POS) transactions

Our $30 grace allowance means no fees for debit card transactions if your overdrawn balance is less than $30.5

Opt in and opt out in real time using our Courtesy Pay Widget at any time and as often as you’d like.

How to opt in and opt out of Courtesy Pay:

- Log in to the Mobile App or Online Banking

- Click More

- Click Courtesy Pay

*Data and carrier rates may apply.

1Cash back is calculated based on the total dollar amount of qualifying debit card transactions. Account will not be dividend bearing. 1% cash back on first $1,000 in transactions. Maximum cash back is $10. For minimum requirements to be met, actions must be performed and must clear/post to the account during the qualification period. Transactions may take one or more banking days from the date the transaction was made to post and settle against your account. Swipe & Sign, PIN, and Debit Bill Pay transactions must have cleared account by the end of the month. Standard fees will apply such as an account that has been inactive for longer than 12 months. No overdraft fees for debit card transactions that overdraw by less than $30. This only applies to debit card transactions. ACH transactions do not have the $30 grace before a fee is charged. Overdraft fees must be repaid within 45 days. A $30 fee is charged for each occurrence. Courtesy Pay will not be paid if Courtesy Pay is disabled and the transaction is declined. In those cases, an NSF fee will be charged. Courtesy Pay covers the following types of transactions: checks, ACH, and other transactions made using a checking account, automatic bill payments, recurring transactions set up using your debit card, ATM transactions, everyday debit card transactions, and Point of Sale (POS) transactions. ATM transactions, everyday debit card transactions, and Point of Sale (POS) transactions require separate opt-in.

2In the event that you do not have enough money in your account, you will be charged an insufficient funds fee per check.

3Mobile Deposits are subject to verification and up to $200 is available for immediate withdrawal. Your accounts must be in good standing; cannot have an account in bad standing, a negative ChexSystems record or have any delinquent loans for more than 30 days. Read the Electronic Funds Transfer Agreement & Disclosure (Reg E) for details including funds availability, deposit limits, proper disposal of checks, and full terms and conditions.

4ATM transactions, Everyday debit card transactions, and Point of Sale (POS) transactions require separate opt-in.

5 Overdraft fees must be repaid within 45 days. A $30 fee is charged for each occurrence. This only applies to debit card transactions. ACH transactions do not have the $30 grace before a fee is charged.

Apple, the Apple logo, iPhone and iPad are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Android is a trademark of Google Inc. ©2019 Google LLC. All rights reserved. Google Pay is a trademark of Google LLC. Samsung Pay is a registered trademark of Samsung Electronics Co., Ltd. See the full list of stores that accept Samsung Pay at www.Samsung.com/pay. Data charges may apply.

For your protection, we use the latest encryption standards and, therefore, support the latest two versions of the following browsers and operations systems: Google Chrome, Firefox, Microsoft Edge, Safari, iOS. We support Android v5.0 and above and provide limited support for Internet Explorer v11. While we do monitor fraudulent or suspicious activity and may proactively contact you about this activity, we will never call and ask for confidential information, such as your entire account number or PIN. Contact us: 703.526.0200 x4 if you have provided confidential information.

Federally insured by NCUA. Membership eligibility requirements apply.